As you may know, I’ve been looking into not only insurances, but also super and general finance “stuff” over at least half of 2017. I thought I’d share my experience of this. Also, like everything I blog about on this blog, it’s just my personal experience and this is not an area where I am qualified, so do your own due diligence. (Or don’t, but if you don’t do your own due diligence, don’t come and complain at me about it because I won’t care and it’s highly likely I will point and laugh at you for NOT doing your due diligence. You’ve been warned, ok?)

Settle in – this is a long post full of finance stuff. Maybe get your preferred caffination first. After all, it is finance & insurance stuff…

There are three main sections to this very long blog post: Finances, Insurance, and Superannuation.

Why am I looking at this stuff? Well my prompt was having my tonsils out and the time off work for recovery. You see, being all viral for ages before the surgery and two weeks off work for recovery wiped out my leave balances. So I asked myself, what would happen if something more serious happened? Lets face it, I can attest to the fact that tonsils and the pain and suffering they inflict can suck grand hairy balls, but in the grand scheme of how bodies can screw you over, they are pretty minor.

Additionally, as the sole income earner for my household, I would rather that I was very well insured. The last thing anyone ever wants to do is deal with Centerlink.

Especially as I think curse words are too kind for those who think cashless welfare cards are a good idea (literally how dare they make people buy fruit and veg at Coles and Woolies instead of fresh at a market; unless markets are only for who they think are upper class). The entire cashless welfare card topic infuriates me but there are other people who can write about cashless welfare articulately and not just my “aaahhh” of rage at the stupidity of it.

And it also seems easiest to get insurance when you’re pretty much healthy (I of course have disclosed my history such as tonsils etc to all companies). One guy from an insurance company said it’s great to hear me getting it all in place now; it seems many of their queries come from people in their mid-late 40s or 50s when bodies start to do funky things and the insurance is then much more expensive (or may not cover existing conditions). So it seems like this stuff might be worth thinking about if you’re in your 30s like me. They all seemed shocked that someone under 35 was looking into this, though they completely understood when I explained my tonsils and leave balances!

2017 – The Year of Extreme Finance and Insurance Adulting

Part 1: Finances

Increase Your Take Home Pay

Being someone who works not in government exactly, but somewhere that has a lot of government conditions “leftover”, I was able to pay for some of my super with pre-tax money so that I had more take home money. This came about via my super fund; when I went to meet with the general consultant to learn about insurance held in super (see below) they noticed I didn’t have the most tax efficient set up, so they recommended a meeting with a financial adviser. I booked a meeting and the entire process was quite simple:

- A phone call where we ran through what I wanted (more take home pay).

- I sent them some pay slips and the balances of my super accounts.

- They did their magical accounting calculations.

- We scheduled another phone call to look through their advice, which I took.

There was a fee for this, but it was able to be deducted from my super balance, rather than paid from cash on hand. Which is good, because I didn’t have $400 on hand to pay for them.

From my magical and extensive (not) knowledge of this stuff, it seems salary sacrifice is mostly available to government, government-ish and charity/not for profit types of jobs. Still, it’s a quick question you could ask a payroll department/person. Google could probably tell you more than I know on this as I’ve literally never even Googled it. Actually, I’d trust Wikipedia on salary sacrifice more than I would my knowledge. I’m still not entirely sure how it works but I do get slightly more take home pay now, so I’m going with a bit of blind faith here, as I just don’t “get” the topic.

Emergency Funds

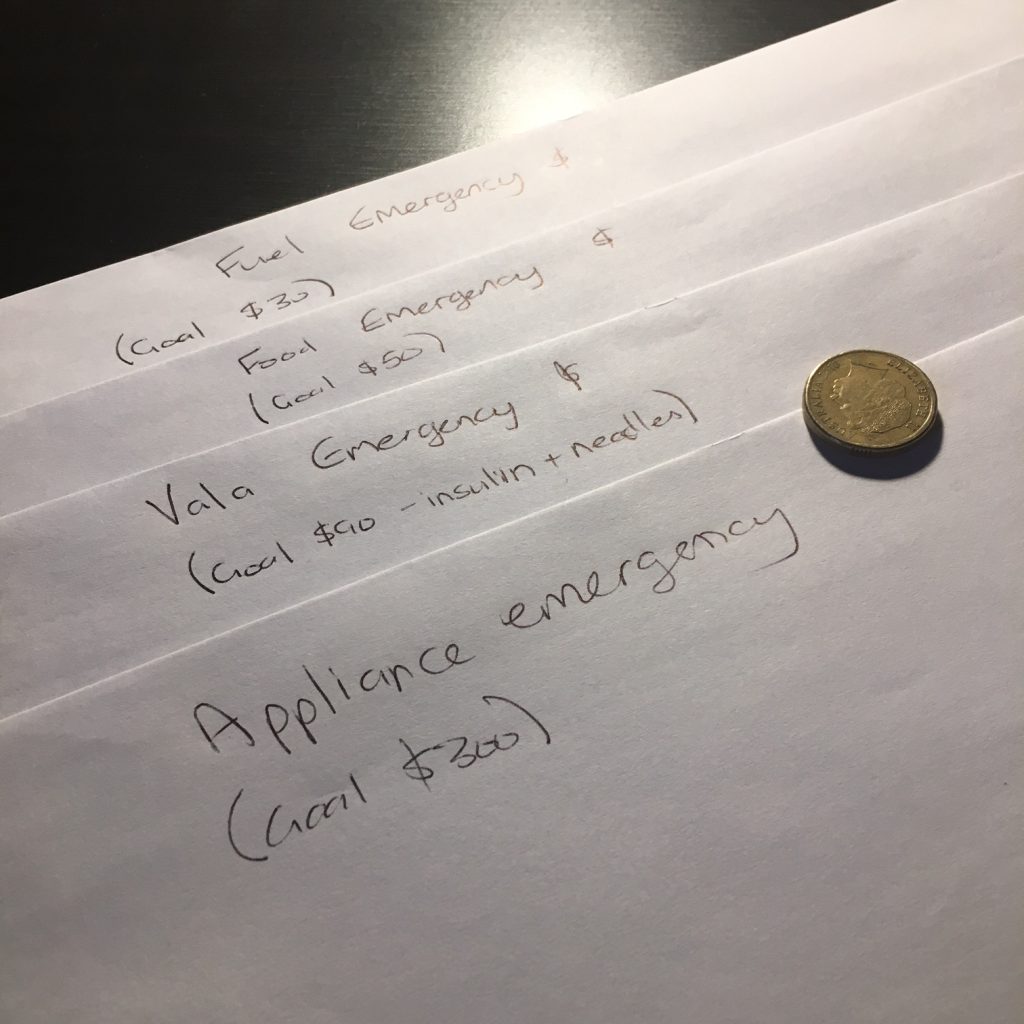

I have two types of emergency funds currently. One is a bank account and one is not. Coincidentally, just before my fridge started making weird noises, I grabbed some envelopes and wrote a few things on them. Basically I wanted a cash fund for a few basic emergencies/necessities if all our income suddenly stopped with no warning (which has happened to us before). I decided to cover:

- Insulin for my dog (she’s a type 1 diabetic, so she gets two needles per day)

- Food for a week (nothing fancy is needed in an emergency fund, think pasta, frozen veg, any household items you’re out of)

- An appliance breaking down

- Fuel/transport

- Small medical expense (eg a prescription or two)

I’m not sure if I will stick with the envelope system. I really like the idea in theory but so far the envelopes have only a few gold coins in them each. Because I never really have cash on me. I’m going to call it an experiment for now and just see how it goes. You never know unless you try these things. I do like the idea of different amounts for each emergency, because it feels more planned to me than one big sum somewhere. I decided to put the $2 coins in the envelopes that are for “big” amounts and $1 coins in the envelopes that are “small” amounts. I have had to raid it already in one particularly bad pay period to buy bread and fuel, so it may not perfect but it was a bit handy already.

The other emergency fund is a fee-free bank account. It’s pretty much brand new so the account is basically empty, but it’s where I’ve started a habit of transferring money (even if it’s just $10) every time I get paid. I figure anything that is regular is better than nothing. The reason I went with a 100% separate bank for this account was just that I prefer to not have it visible or feeling “mixed in” with my current bank accounts. Effectively, I don’t want to see if when I log into online banking. It’s really a personal preference thing (as pretty much this whole post is, in case that hasn’t been obvious so far).

Tip: look at credit unions, ING, Citibank etc for fee-free everyday accounts where you can start to build small savings that aren’t quickly eroded by fees.

Travel Fund

I grew up living in a few countries and moving lots of times. I have dual citizenship. And yet the furthest I’ve gone in recent years is to the Gold Coast for ProBlogger. That’s an hour away from my home. I miss being able to travel. It’s hard to afford travel in a single income household full of medical expenses. That’s just the reality. It has been so long since I did travel that I don’t even know where I want to go, how I want to travel, or …anything. I’m thinking that budget-wise, I might need to see if I like camping?

Anyway, I miss the visual stimulation of somewhere NEW. So I opened another 100% bank account in another 100% separate bank. Again, it’s the sort of thing where I’m putting $10 per pay or something away. Nothing large, and it won’t add up to some round the world trip any time soon. But it’s a start, and a start is a healthy and positive place to be. You don’t get to a middle or end or outcome without a start.

It helps that I’m not an “I doubled my income in six seconds while doing cartwheels on quicksand drinking a cocktail” type of blogger and/or person. A start is a good thing. It doesn’t have to be some fancy dressed massive outcome.

Review Bills

Reviewing your bills is something that is so easy to put in the too-hard/too-boring basket. To be honest, the only bills I’ve reviewed are the teleco ones – so that’s our home phone, internet and my mobile phone. It turns out that it was CHEAPER (so ridiculous) for me to get a new iPhone on a plan and move to unlimited NBN on Optus than it was to keep my old phone plan and (limited data) ADSL on Telstra. It saved me $30-50 per month to swap (depending on how many calls I’d made in previous bills with Telstra).

It has been a very long time since I’ve reviewed electric companies to see if we could be paying less, but I’ve had enough of finance stuff this year, so that can be a 2018 task. I actually miss non privatized electricity and wish we could go back. I’m anti privatization of essential services. Also, when I was cleaning out a pile of paperwork one weekend, I found an electricity bill from around a decade ago that was only $85. I miss that. Do you miss affordable electricity? I do.

Consolidate Bank Accounts

This bit was kind of laziness. Because I stopped Bloggers and Bacon earlier this year, I deregistered it as a business name. Which eventually lead to me going to my bank and closing all the business accounts I had opened in the past decade and not used. Yeah. I had kind of let that slip a bit. I had basically ended up with 5 business bank accounts I didn’t use, and one that needed a name change. Also, it appears that doing this causes fire alarms, evacuations, chocolate, half breaking the bank’s systems and a very long lunch break. (Yes, that trip to the bank was epic in itself.)

Part 2: Insurance

Insurance Within Super

Check what you are already covered for. Seeing as superannuation is compulsory for employees, if you’ve ever been an employee, it’s likely you already have some insurances. It seems like an obvious statement but I only ever looked into this for the first time mid year. I found out that I have some income protection (more on that below) within my super fund. That seems to be rare, but I don’t know enough to say that for certain. I also found out that it’s really, really cheap to have an increased amount of death and TPD (total and permanent disability) cover via super, so I applied via my compulsory fund to increase mine to what I decided were more practical levels.

In choosing to increase my insurances, I mainly thought “well stuff is expensive these days and it will only get more expensive”. Yeah, that’s why you shouldn’t take my advice on this stuff, that was literally my decision making process for the death and TPD coverage amounts.

If you increase your cover above the default level, you have to go through “underwriting”, which is a fancy (aka boring AF) industry name for assessing your “risk” to the insurance company. For me, that meant I had to go to the doctor and have my weight, height, waist and hip measurements taken, along with a urine sample to test for words I don’t know, and my blood pressure. The doctor filed it in on a form and I emailed it back to the insurance company. I assume the more conditions you have, the harder, more expensive and the more things they want to know about you.

In related news, I have to assume it’s so much easier for men to pee into tiny jars than women. Why hasn’t someone fixed this yet? Or am I just under-skilled at peeing into jars? Is there a course I can take? A 10 step, never-fail formula I can buy?

Be prepared to be judged on the outdated BMI. I have a lot of issues with the apparent trust by insurance companies in this calculation. If you weigh more and eat healthy, you’ll be judged as “worse” than someone who weighs less and eats crap. Probably something that deserves its own giant rant, but please be forewarned and mentally prepared to be reduced to and judged on an outdated numbering system. If this is something that would be sensitive for you to cope with, make sure you have some support before going through it. I find the inaccuracy of the data frustrating, rather than feeling personally victimised by it.

Also, I checked the insurance premiums within super accounts that I don’t currently use (more below on that). I found that in one account I had been assigned a default risk rating, so I answered less than a dozen questions and they immediately dropped my premiums across the default Death and TPD coverage. I saved a total of $113.88 per year on insurance premiums. That’s not bad, and it’s extra money in my super fund now. I was able to do this via the online portal, so I didn’t even need to speak with a human. Win! I’ve had that account for YEARS so that’s probably nearly a thousand dollars I could have saved if I had looked into it much earlier.

It turns out those annoying people who tell you to review your super and know what’s going on with the accounts are actually onto something. WHO KNEW?! (Oh geez, I just realised this blog post makes me one of those people!)

Insurance Outside of Super

I decided to take out both Income Protection and Trauma cover external to my primary super fund.

I actually did have some Income Protection insurance via my super but it didn’t really cover a large percentage of my salary. Obviously it’s better than nothing/Centrelink, but it wasn’t a replacement for a decent income protection policy. I found out it’s also only valid while I remain in my current job or same industry. While I have no immediate plans for job or industry changes, it’s certainly not un-forsee-able. Plus I do not see myself doing this job until retirement age. I frankly doubt my job will exist until retirement age anyway! I actually don’t think I can cancel the income protection I have via my super fund, so while I am probably technically over-insured, it’s the better choice for me personally in the long run to NOT rely on income protection via my super fund. If that makes sense. (If ANY of this makes sense.)

I wanted to be very well covered in this area (again, the sole income earner) and applied for a better Income Protection policy from a private company (aka not via super). I also took out a Trauma policy.

It took me a while to learn about the difference between income protection and trauma; income protection will pay you a percentage (75-85) of your salary if you become unable to work. It can pay for 6, 12, 25 or 60 months. Or you can do what I did and apply for a policy that would cover you until you are 65. (Again, I said I wanted to be very well insured and not have to talk to Centrelink if I was to need this coverage. Personal circumstance and what gives you peace of mind matters a lot in making decisions here.)

Income protection has a period of time you have to be not earning for before you can claim; a waiting period. This seems to vary from 14 days, 28 or 30 days, 90 days (and I heard some are longer but I never saw them).

How long you wait before you access it and how long you receive benefits for are variables that impact on how expensive the premium you pay per fortnight is. It appears income protection insurance premiums (only if paid outside of super) are tax deductible, but of course, ask the ATO or swear at your eTax software to learn more about that. Remember that if you have a long waiting period, you’d possibly need money saved to tide you over in that time.

Tip: Don’t be afraid to ask for lots of quotes from lots of insurers. Vary the amount of benefit period and wait period to see what coverage suits you and what the premium will be.

Trauma policy is a bulk (I think in insurance land they refer it is as “lump sum” but I don’t like that term for absolutely no rational reason) payment that you receive if something happens. Something traumatic, obviously. It’s the cancer, heart attack, lose a limb type stuff. You know, traumatic. It gets paid to you and what you do with it is up to you, though I assume most people would use it for immediate living expenses and medical bills. A few of the websites had stories about people using whatever was left of their trauma payout to take a holiday before they returned to work, which seems good for mental health in theory but kind of a weird thing to write about on a website about your insurance. I think of Trauma vs TPD as recoverable but serious vs oh fuck this is a very different life now insurances.

Trauma and Income Protection policies seem to intersect. Basically they are 100% different products but you can use them in complimentary ways. Seeing as both are income streams for if something big and bad happened, the going thought (and lets add in another disclaimer of I DON’T KNOW WHAT I AM TALKING ABOUT AND I AM NOT QUALIFIED) seems to be that if you’re eligible for income protection to pay out, you’re probably eligible for trauma to pay out. Which means you could possibly look at getting a cheaper premium on the income protection by having a longer wait period, because you would get the trauma cover paid to you in one go in the meantime.

Want more from NormalNess? Sign up to my newsletter and you won’t miss a post!

My understanding is that Trauma insurance pays out upon diagnosis of a condition – whereas other insurances such as income protection and TPD pay out on different variables, such as if you can work in your or any field again. It’s very complex and I spent literally months going around in circles trying to find out what made sense to me and what made sense for my situation. It also depends on if it’s within superannuation or external to it, and what the individual company wishes to offer you.

Basically, the entire thing seems like a giant gamble and no one knows anything for sure. In the end, all of these seem to be based on what level of cover a) comforts you/brings you piece of mind b) that you can afford the premiums for. Those two things will logically vary for everyone and I think the only way you get to a decision point is by getting a ton of quotes. In the end, I pay about $9 per week for what I think is a reasonable amount of Trauma cover.

And Then…

You might remember that I said I wanted to get both Trauma and Income Protection external to my compulsory super fund. After a long, boring, and annoying process, I found that I had been… not lied to as such, but I was given to understand that I was within the BMI range to NOT receive a penalty loading on my premium. So when my application was approved, I got a nasty shock at the premium they offered me because of my BMI. As such, I only accepted the Trauma component and went back to a different super fund of mine, where I’m in the process of applying for Income Protection. The change in my strategy to get Income Protection via a different super fund is purely for my personal cash flow, primarily because we will likely be purchasing a car in the next 12 months, which means I’ll have a car loan again.

Insurance companies do offer you a chance to get below their BMI, and keep the weight off for a period of time (assume a year, to be safe, but it seems to vary between companies/policies), at which time they will review with a look to reducing the premium. Given that I hadn’t been expecting a loading, that wasn’t good enough for me, and it was a high amount to budget for. I also am not a) a believer in the ridiculous BMI b) not someone who wants to feel the pressure of quickly losing weight to save cash. I’m currently losing weight on my own terms, thank you very much! Again, like literally everything here, personal choice plays a big part.

So that frustrating “happening” means that as of publication of this post, I’m now a) waiting for the private company to get back to me with paperwork for the trauma insurance only and b) waiting for the “results” of another “quick medical” via the super company. More peeing in cups. I’m a freaking expert now, I swear.

Tips On Insurance Companies

I got quotes from a few who had what I deemed dodgy/unethical practices. Basically they wanted me to sign up right then and there on the phone because it’s ok, there’s 30 days to change your mind. Haha. No bloody way. Most insurance people are sales people so you need your I WILL SAY NO voice and be able to use it. I have no idea if these types of sales tactics are in line with whoever regulates the insurance industry but they didn’t align with the standards I expect of someone selling something as possibly vital to a good life as insurance.

Also, it seems most are only open working hours. Which really sucks if you’re like me and work generally office hours. Double worse if you work in an open plan office and you can’t really take personal calls for obvious reasons. Triple worse if you have a commute on top of those two things. This is another reason it took me so long to get quotes and work out what I wanted.

Random middle of the post disclaimer: this is provided for entertainment purposes only, and should not be construdled as financial advice. Because that’s what I’ve seen written on other blogs. Why the hell anyone would consider this stuff entertainment is a topic that probably needs its own 6500+ word rant because if you think this is entertainment, HAVE YOU FREAKING HEARD OF NETFLIX?!

Private Health Insurance

I’ve always been a bit “what’s the point” on private health insurance. Hospital cover seems to only cover surgeries and when your needs are more ongoing outpatient visits than surgery and admissions… it’s a lot of money for what seems like very little return. I still see no value at all in hospital cover. For our needs. Our needs might very well be different to your needs. (Someone on Twitter did tell me that “back in the day” outpatient things used to be covered. That would be incredibly valuable to our lives and would make me look at getting hospital cover.)

However, following Ben having an expensive tooth emergency, we both now have extras cover, 99% for the dental benefits portion. Again, this sent me down a rabbit hole of comparing quotes and getting feedback and learning how it all works.

Private health tip: there’s no need for you and your family/partner to have coverage with the same fund. If you don’t have the same health needs, what’s the point in paying for what you don’t need?

I know I need minor dental work done, such as a good clean and a few minor fillings. I found this out last year and didn’t know how to pay for it so I just kind of ignored it. I found a very cheap extras policy via AHM that is $6.20 per fortnight and gives me 50% back on extras. It gives me $400 of general dental per year and $300 of physio. It is literally perfect for my needs. Even better, no preferred provider stuff to wrangle with.

Knowing that Ben has some more complex dental issues (even excluding the recent emergency visits), we chose a different provider for his dental cover. He has a BUPA policy that costs $23 per fortnight and 60-66% back – with no limit on general dental which was a really, REALLY big selling point. It covers a lot of other things too (such as major dental, optical, speech therapy and a massive endless list). Sadly BUPA have the preferred provider stuff to deal with. However, it (very) luckily turns out that our preferred dental practice is a preferred provider. So that was good! If we moved or the practice quality changed, I’m not sure if we’d have to reassess if BUPA would still be the right provider.

FYI, the links above to health funds are NOT affiliate links, they are provided for your information only. A few people I spoke to offline after the dental emergency were curious about the dental cover I found for both of us so I wanted to share them in case you’re also curious. I was surprised to find that it was quite affordable for us – even as a single income household. Basically, having the extras cover would allow me to afford one dental “thing” to be fixed per pay period if needed. I found that for me, extras cover is actually part budgeting tool as well as part insurance.

We may decrease Ben’s coverage to be more similar to mine after a few years when he’s had the majority of his work done. Conversely we may choose to increase mine to cover more things on the basis of “bodies only do more weird shit the older you get”. It’s something I’ve got on my mind to review annually and make a choice based on needs.

I really wish extras cover didn’t cover “natural therapies” though. I prefer my medicine to be science based and I don’t want to subsidise wishy washy stuff. If you like natural therapies, go for it and use them, by all means. Do it at your expense though. Money in a collective health pot should be used for scientific treatments, not wishful thinking.

UPDATE: I’ve been writing this post for the past 6 months, and after I wrote that above part about natural therapies, the government has removed a lot of natural therapies from private health. Yay! They have increased ability to access mental health services via private health, which obviously isn’t bad, but I think they could have done more in the public sector first, to be honest. One article I read did say that the author wished they’d address outplacement needs under private health in future reforms, which, as I said above, would be a massive fucking yes from me. I really hope they do look into that one day.

Car Insurance

I wasn’t actually planning on reviewing my car insurance, until I got bored one day and thought “Ok, I’ll get a quote somewhere else just to see” … which was followed by “Hmm, why is everyone $20 per month cheaper than I’m paying now!?!”

I ended up calling my insurer to ask why some things cost more. It seems that despite the fact I’ve had the same insurer the entire time I’ve been a driver, they never worked out I haven’t had a claim. So there was one immediate discount. I can see the benefit for them (uh, increased premiums) in not bothering to check this stuff but it left me feeling ripped off and cranky.

We chatted through a few options – to understand what I currently have cover for and what I don’t – I actually didn’t have a clue what I was covered for, all I knew was that I had comprehensive cover. In the end, with the things I removed (and one I added) I saved $10 per month on my car insurance policy. I think it’s cheaper if you do it online but then I also got confused – should I have called, asked questions, said “don’t make changes” and then done it online for the online discount? I don’t know. I’ve saved $120ish per year from a single phone call so that’s a better than nothing.

Contents Insurance

I feel really bad/guilty/failure-as-an-adult for admitting this, but I had never had contents insurance the entire time since I left home at age 19. At the ripe old age of 31, I figured it was time. The weirdest thing about contents insurance is that they tell you to add up what it would cost to replace your items. As someone who second hand shops for most household stuff, that makes me feel like I’m ripping them off by saying it would cost $x to replace something I bought second hand for $y. Logically I know that it’s because you’d probably just want to BUY the stuff right away and move on with your life if you had to make a claim, but it still felt weird to me. Anyway, it’s pretty cheap to get (well, it was for us!) so now that is one that is ticked off. And QLD storm season, please don’t send any ex-cyclones over my house again this year because a) they’re scary and b) I don’t want to make a claim just because I have insurance now.

Part 3: Superannuation

Super Accounts – Finding Them All!

Oh geez. Super accounts. The fact mine were in such a mess was no one’s fault but my own. The years I spent doing contract work meant that sometimes I was filling in my employment paperwork at an interview, so if I didn’t have my super fund details on me, I went with their default fund. So that equals ALL THE ACCOUNTS. And so much wasted super. At my current day job I’m in a situation that is rare these days – they have no obligation to give a choice of super fund. Seeing as it’s my first permanent job ever, I undertook all the super stuff (and the insurance stuff above) with the goal of consolidating to the fund where my current employer pays my super into.

The first thing I did was try to find all of my super funds. I got a bit confused with this for a while and didn’t want to dig through the messy pile of paperwork in a stack on the bedroom floor … and then one day I found out that the ATO has a list of them all. Which was one of those duh/ah-ha moments. I logged into MyGov, connected to the ATO and voila, a list of my super funds. Yay! A government thing that was actually simple. (WHO KNEW THAT WAS POSSIBLE!?)

Balances Under $200

I had read (somewhere, just google it because I cannot remember where I found it) that funds with balances under $200 can be withdrawn. This was at the time of the aforementioned tooth emergency so I was woo hooing (not in a Sims way) at the thought of quick access to cash. It turned out to be one of those half true things. I only had two accounts that were under $200. One I could withdraw, but it had such obscene exit fees that I got like $85 from them. Pfft. Disappointing. Exit fees should be banned. It’s my fucking money. Anyway, I put that $85 into my above-mentioned emergency fund. Though I’m thinking that as a weird kind of reward for doing so much extreme adulting this year I will move it to my travel fund.

The other fund that was under $200 apparently is a type that can’t be withdrawn as cash. I have no idea why, but boo to you, random super fund. They also charged exit fees so I transferred the cash to my main super fund. So it grew by like $30. Whoopdee freaking doo.

All the other funds I had that had more than $200, but still not much in them, so my goal is to roll them into my main super fund. The problem is, some of them aren’t letting me. I’m not sure why and I’ve had enough of it this year! It’s something I’ll chase up with individual funds in 2018.

Consolidating Super Funds

I’m now down to looking at how to manage only three main super funds (yes, I had so many that “only three main funds” is a good place to be in!), and this is where I have given up for now. I have my main one, and two decentish sized ones from other jobs. (I have no what a decent sized super account is in the wider world, I’m just calling it that on the comparison of the balances I had across all my accounts.) I know one of them doesn’t have an exit fee, so I could easily roll it into my main fund. But I haven’t rolled these two other accounts yet because I figure this is where I need to look into if the accounts would have any special “things” I want to keep. Again, I am not even really sure what special things are. Maybe the way it pays out at retirement? I’m still trying to learn about things like accumulation vs defined benefit and do I have one or both of those… I really don’t know, and I got too worn out and bored by super to dig that deep. Maybe that can be a 2018 task.

At least it’s in three manageable accounts, all of which I have access to online now. That is a big step forward from where I was, for sure and I’m happy to leave it there for 2017. I do want to get down to two accounts (my compulsory one and the one I’m currently applying for Income Protection through, as mentioned above) because when I looked at the fees for the main two unused accounts, they bill me over $500 a year EACH in fees for gambling my money.

Things I Don’t Understand About Super

It seems that super was all invented with the idea that you have one secure job for life. And somehow also that the economy doesn’t change? I don’t really get it. I’m lucky (from what I understand) to have a partial defined benefit fund in one account but I have no understanding of what happens to that if I change jobs and/or if I’m not in a job that funds that type of super when I retire (will gen y ever be able to retire?). And if it’s all accumulation, which means you are being forced by the government to gamble on the stock market. I disagree with basically all of how world finances work (which is a massive topic of its own), but what it boils down to is that you get 9 or more percent of your “expense” as an employee taken off you where someone else charges you fees to gamble it. And it’s YOUR risk that if you want or need to retire when it’s a downturn because then you might not have the money to. But you have no say in this system. That seems particularly fucked up to me.

I’ve also seen from other blogs and news in general that the constant changing of super rules and conditions means that people who are in the position of using/needing their super are impacted by changes to things they’ve worked their whole life for. How can a system that’s meant to be for life be changed on a whim? So, plan for the future, but we might change the rules on you and it’s your fault if it’s a bad time when you want to retire.

Go home super, you’re drunk.

I am very sure there is a lot I don’t understand about super and the stock market and super regulations. It doesn’t mean I can’t view it as messed up and irritating and no reason why I can’t have a mini rant about it right here 🙂

Random other things I learned:

- Income protection payments seem to be paid in arrears. So if you choose a 30 day wait, you won’t get paid until 60 days time. Effectively, you whatever your waiting period is, you will wait another month before you get money. Keep this in mind if you are going to rely on savings to bridge the gap between work and income protection kicking in.

- You do need to read the PDS (Product Disclose Statement) they send you. Yes, they are large. Yes, they are hella bloody boring. But they contain good info and they helped me make the choice (along with premium cost, obviously) of which insurers I liked.

- Insurance quotes vary wildly. There is little consistency in the premium amount. I got quoted a LOT for very little coverage from some companies. You really really really need to shop around because if you don’t, you could pay a lot for complete crap. I don’t like middlemen so I didn’t use comparison sites, I contacted companies directly for quotes and info.

- MoneySmart (run by ASIC) and Canstar seem like pretty good websites to get more basic info. I learned a lot from them. Please go read them if you want to learn more.

- Insurances all seem to wildly discriminate about any kind of mental health condition, which should be illegal and for some reason I don’t think it is illegal. Is a brain not part of our body the way a leg is? I really don’t get this and I think the insurance industry needs a kick up the ass here to get with the fucking times.

- Similarly, some insurers classify things like fibromyalgia as mental health conditions and others classify it as an autoimmune condition. This is REALLY why you need to read the PDS documents.

- Get a binding nomination for who receives your super when you die. Apparently filling in a preference/name online is not the same as filling in the binding nomination from. It is easy though, just google your super fund name and “binding nomination” and you can print it out, get it witnessed and post it back. Do this for every fund if you have more than one.

- The Government’s Money Smart website has a life insurance claims tool page. This might be worth factoring in to your choice of insurer.

Should I Look Into This Stuff?

Well, probably. It’s all your money and your life, so it’s your decision on what to do with all of this. It is a LOT though. A lot of phone calls. A lot of quotes. A lot of forgetting what this, that and the other means and asking yourself the same question a dozen times over until you think you know what part of it means, only to forget a related part and then you go back to the start again and wonder why you are putting yourself through this. I started looking into this stuff in around July, so it has taken me literally months of calls and questions and quotes and research to make a decision, then more time to apply, get my pee tested and wait for responses, change my mind, and set up which account I want the premiums taken out of. And that’s just talking about the insurance side of it all!

2020 Finance Update – See what did and didn’t work for me

In Summary

Lastly it’s worth repeating, these are the decisions that I made based on my needs and I am not an expert or qualified in finance or anything remotely related to finance, I am someone who wants to never need Centrelink in the case of a disaster. I called a lot (A LOT, I can’t stress that enough!) of super funds, insurance companies and got lots of quotes before I made a decision based on what I think I need. It is a LOT of work. A lot. I know I said that above but it’s worth repeating.

Any tips for updating and/or managing your finances, insurance and super? Or is it something that is in your “one day” basket as it’s all a bit confusing and intimidating? If I missed anything you want to know about, ask me below and if I know the answer, I’ll see if I can help, so long as you agree not to sue me because I’m not an expert and also I don’t have much money, so you wouldn’t get much if you did sue me, and if you did sue me, we wouldn’t be blogging friends anymore and I like my blogging friends and I’d like to keep you all.

WOW. You have been extreme adulting. I learnt quickly I have to pull the tax out as soon as the money hits the bank account. It sits on the homeloan until the BAS or income tax bill hits but at least i know it’s all there….

It has been an intensive 6 months. I can’t wait until the last few bits are set up and then I can just review things annually.

It’s always good to put the expenses away first; no risk of it being spent then!

so much valuable information on this post! I intend to follow a bullet journal this year and I hope to add some financial goals, so I plan to take your info and make my own charts! Thanks heaps!

Glad it helped! It has been a LOT to try and learn and make decisions on and I’ll be so happy when the last few bits are done and then I can just review it annually.

Some great tips – especially the envelopes! I’m going to get stuck into the Barefoot Investor over Christmas and sort out the finances good and proper. Totes need to do a bill review – I did transfer my mobile to Amaysim and have saved $20-30$ a month plus I get free international calls! I agree private health insurance doesn’t cover a great deal but I was so pleased I had it when I needed it and the dental cover is worth it’s weight in gold! I wish I’d been as financially pro-active as you in my thirties!

It really does help to have a little bit of cash backup. I like the envelopes because I can see exactly what I have for each little backup “thing”.

If we were a dual income household or if I earned more I’d take out hospital cover, but with just me earning, I can’t really justify the cost right now. I might take it out as I get older because I guess it’s more likely to be needed!

One of the helpful staff members at my main super fund said something similar about doing this stuff in your 30s, especially with super, it gives you more time to compound and get benefits so tweaking small things when you’re younger can actually make a decent impact on retirement savings.

A financial audit is such a good idea! I think this is going at the top of my personal goals for 2018!

Ingrid

http://www.fabulousandfunlife.blogspot.com.au

It is a lot of work but hopefully when the last few aspects have been done I’ll feel accomplished!

I have learned so much about finance this year- and still going!

To a degree I think we’re always learning, but I’ve got to say, I’m looking forward to a LESS steep learning curve in the future. Maybe just a nice annual review kind of thing 🙂 And less peeing in cups.

We’ve always done the pretax salary super thingie – although as hubby is in a different age bracket to me, he can access his super at an earlier age so we’ve concentrated on his rather than mine. All of this came to the fore this year when hubby took an early retirement and for a while there we were living on the buffer we’d (thankfully) built up. We had to re-do all our super & consider his insurances (previously built into super) as a result of that. It’s a lot of work, but a financial audit is something everyone should do at least once a year.

It really is a lot of work but hopefully less intensive to review annually rather than set up.

Ok, I’ll admit that when I saw the words Finance and Insurance my eyes glazed over but how frigging interesting a read it was. It has me motivated!

My eyes glazed over a lot in the 6 months I spent doing all of this haha. But now that most of it is all set up (or will be soon) I hope it’ll be a lot less intensive to just review it each year. It is a lot to look at and learn about though. Maybe tackle one thing at a time instead of trying to do it all at once like me 😉

My worst habit Vanessa is NOT shopping around enough for competitive pricing for insurance. I did so for my home and contents cos my previous insurer increased my premium hugely and then weren’t helpful when I queried it. So I did an online quote with someone else and made the change.

I really need to reconsider my health insurance company as I pay A LOT of money and am pretty sure I could do better. #teamlovinlife

Shopping around took me so long. I found with stuff like income protection in particular, the costs varied really wildly and frankly, to obscene levels of premiums.

Health insurance is so tricky as they all cover slightly different things in the “same” levels. But at least for PHI they can’t discriminate on cost for pre-existing, which is a bonus of the system here.

Wow! This is a super helpful post. Things change so quickly that we can be led into a sort of comatose state, leaving things as they are and thinking that everything will work out fine, when there are alternatives and reviews to be made. Your thoughts and suggestions certainly got me thinking.

Keeping an eye on premiums and making sure your insurance companies/other providers and so on are actually remaining competitive could be a full time job if you let it. Hoping from now on I can just do an annual review and it’s less work, as it has been a full on 6 months to get this all set up properly.

So much important territory covered here. Going to have to come back again and read more closely. I’ve only tackled life insurance and super consolidation myself. That is a good point about different family members needing different health insurance coverage.

SSG xxx

Yeah, the PHI quote fields kept asking if I was a couple and I’m like yes, but why do you care haha.

We seem to have our finances pretty much sorted. We employed a financial advisor a few years ago and have followed his advice mostly. We also always shop around for insurance, health fund and energy providers. #TeamLovinLife

I figured a financial adviser could have helped, but also I kind of like to DIY so I understand it better.

You’ve shared a range of fabulous tips on savings, insurance and super here Vanessa. I’ve embraced many of these myself. I highly recommend speaking with a good financial advisor if you’re unsure about your finances. We did it recently and he was able to set up a plan to maximise our savings and help us plan out our financial future. #TeamLovinLife 🙂

In the future I might use a financial adviser, but I kind of liked doing it myself so I had the chance to learn about it.

When I was the household budget bitch, I did the envelope system. It worked really well at forcing us to stick to a budget. So well that my hubbie hated it. He didn’t like when his alcohol envelope ran out (Lol). Anyway, we don’t do it anymore. I handed all finances to him. I am living in blissful ignorance as to how we’re doing financially. No adulting from me at all!

Oh I don’t think I could do that!!

Wow you have been very, very busy! Crazy how much time this all takes, but it’s so worth it in the end when you know you’re covered for what you need for your own personal circumstances. I definitely budget but don’t use the envelope system as I never have much cash on me. Instead I use separate accounts for monthly expenses and set aside money for future bills and expenses, plus another separate emergency/savings account for unexpected events, home renovations or to save for holidays . Also, I think the Barefoot Investor’s book is a great read for anyone wanting to get their finances on track as it’s full of some very handy and practical tips #teamIBOT

It really took me 5-6 months around work and commute to learn and apply and all that.

Wow! You’re right about the long post but I’m super-impressed about your research and your adulting skills. I do use the envelope method as when I have housemates, they usually pay in cash 😀 Plus it was something my parents did {and still do}. I do need to get better at budgeting and might need to look into my private health insurance to see if I can get a better deal. Working for government, I do salary package and it’s useful. And for car and home and contents, I’ve been sticking with NRMA for years because of their awesome customer service. Thanks for the awesome post.

I’m sure a financial adviser would do a lot of this for you, but also, then you’d have to pay someone and you still need to understand it to make a good decision, so…. I don’t really use envelopes for bills, funnily enough. Just for emergency savings.

[…] “clicks” or until you use it, it’s not a waste. As you know, I undertook epic finance-stuff in 2017. (And you can read more about money in general in this section of my […]